If you’re wondering how to value a heating and air conditioning business in 2025, it’s important to look beyond just the financial statements. In the industrial sector—particularly with cabinet air conditioners and electrical enclosure ventilation—the true value of a business is built on consistent earnings and reliable, high-performance products. When considering how to value a heating and air conditioning business, most professionals rely on SDE, EBITDA, and industry-specific multiples. The industrial HVAC market is projected to reach $285.6 billion in 2025, with businesses typically trading at 1.9 to 3.3 times their seller discretionary earnings. Linkwell sets the standard in this industry, demonstrating how to value a heating and air conditioning business by delivering superior solutions for industrial applications. To maximize your HVAC business’s worth, it’s essential to understand how to value a heating and air conditioning business using the right metrics and industry benchmarks.

Key Takeaways

- Understand key valuation methods like SDE and EBITDA to accurately assess your HVAC business’s worth.

- Focus on building recurring revenue through service contracts to enhance your business’s appeal and valuation.

- Highlight the quality of your products and technology, as these factors significantly impact your business’s market value.

- Maintain organized financial records and operational documentation to attract buyers and streamline the sale process.

- Invest in training your team to reduce owner dependence, which can lead to higher valuation multiples.

Business Valuation Basics

What Is a Heating and Air Conditioning Business

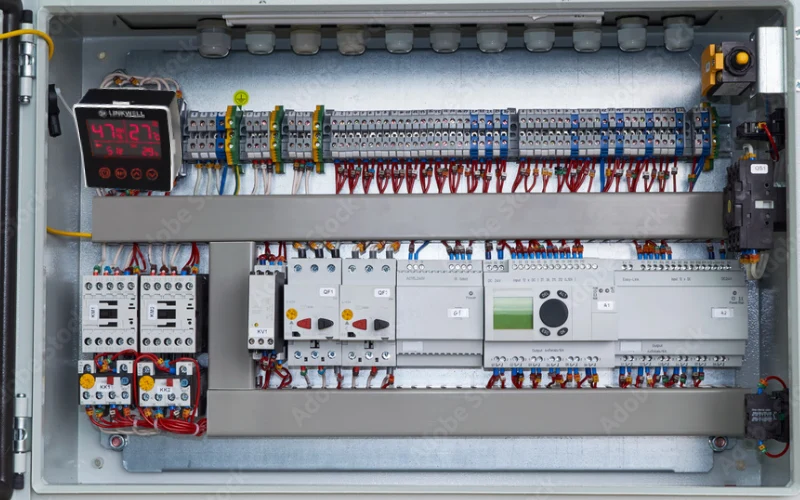

When you think about a heating and air conditioning business, you might picture companies that install or repair home air conditioners. In reality, the field is much broader. Many businesses focus on industrial solutions, like cabinet air conditioners and electrical enclosure ventilation. These companies design, build, and maintain systems that keep sensitive equipment cool and safe in factories, telecom sites, and power plants. If you want to value a heating and air conditioning business in this sector, you need to look at more than just the number of service calls. You should consider the quality of products, the technology used, and the reliability of the systems.

Here’s a quick look at what sets an industrial HVAC business apart:

| Feature | Description |

|---|---|

| Strong Build & Protection | Durable materials like sheet steel or aluminum, with IP ratings for dust and water resistance. |

| Efficient Cooling System | Dual-air circuit systems for effective cooling, with options for air or liquid cooling. |

| Smart Temperature Control | Digital thermostats and smart cooling technology for energy efficiency and equipment safety. |

| Dust and Air Quality Control | High-efficiency filters to block dust and maintain clean air inside the cabinet. |

| Smart Monitoring & Alerts | Features like RS485 interface and alarm systems for remote monitoring and alerts on temperature. |

Electrical Enclosure Air

Industrial HVAC businesses often specialize in electrical enclosure air solutions. These systems protect control cabinets, telecom signal boxes, and other sensitive electronics from heat, dust, and moisture. You’ll find that a well-designed enclosure air system uses advanced cooling, smart controls, and strong filters. This keeps equipment running smoothly and extends its life. If you want to value an hvac business in this space, you need to look at the technology and reliability of these systems. The right products can make a huge difference in your hvac business valuation.

Why Accurate Valuation Matters

Getting the right valuation for your heating and air conditioning business is crucial. You want to know what your business is truly worth before you make big decisions. A professional valuation helps you set a fair price if you plan to sell, attract investors, or plan for growth. It also highlights strengths and areas for improvement. In the industrial sector, accurate hvac business valuation means looking at recurring revenue, product quality, and customer relationships. If you use a professional valuation, you can spot opportunities to increase value and stand out in a competitive market. Remember, the right approach to valuation can help you maximize the value of your business and secure your future.

Air Conditioning Type

| Type | Description | Best Application |

|---|---|---|

| Cabinet Air Conditioner | Specialized cooling for electrical, control, and telecom cabinets. | Industrial enclosures, base stations, automation systems. |

| Central Air Conditioning | Ducted system for whole-building temperature control. | Offices, malls, residential complexes. |

| Window Air Conditioners | Compact, self-contained unit for single rooms. | Small rooms, apartments, temporary use. |

| Portable Air Conditioners | Mobile cooling unit with exhaust ducting. | Rental spaces, spot cooling, temporary setups. |

| Ductless Mini Split Air Conditioners | Outdoor compressor with one or more indoor units. | Retrofits, server rooms, zone-based cooling. |

| Floor-Mounted Air Conditioner | Installed near floor level for restricted wall height. | Rooms with obstructions, low-wall installations. |

| Smart Air Conditioner | Wi-Fi controlled, supports remote operation and scheduling. | Modern homes, offices with IoT integration. |

| Geothermal Air Conditioner | Uses ground-source heat exchange for high efficiency. | Large facilities with long-term energy goals. |

| Dual-Fuel Air Conditioner | Combines electric and gas heating/cooling for efficiency. | Mixed-climate regions, year-round use. |

| Evaporative Air Conditioner | Cools air via water evaporation, low energy use. | Hot, dry climates only. |

| Built-In Wall Air Conditioners | Permanent through-wall installation. | Hotels, dorms, small offices. |

| Variable-Speed Air Conditioners | Inverter-driven compressors for efficient modulation. | Energy-conscious buildings, quiet operation zones. |

Recommended products

How to Value a Heating and Air Conditioning Business

Key Valuation Methods for HVAC Business

When you want to know the true value of your hvac business, you need to use the right valuation methods. Most buyers and sellers look at three main approaches: Seller’s Discretionary Earnings (SDE), Earnings Before Interest, Taxes, Depreciation, and Amortization (ebitda), and industry multiples. These methods help you see what your business is really worth, especially if you focus on industrial solutions like cabinet air conditioners and electrical enclosure ventilation.

If you run a smaller hvac business, usually with less than $1 million in revenue, SDE is the most common method. It shows the cash flow available to you as the owner. For larger companies, especially those over $3 million, ebitda becomes more important. This metric focuses on your business’s operational profitability and is often used by investors and larger buyers.

Here are the key steps you should follow when valuing your hvac business in 2025:

- Gather your historical financial statements.

- Normalize your owner compensation.

- Calculate your ebitda.

- Calculate your SDE.

- Apply the right industry multiples.

Tip: If your business specializes in industrial HVAC products, like Linkwell’s cabinet air conditioners, you may attract higher multiples due to strong recurring revenue and advanced technology.

Calculating SDE and EBITDA

You need to understand how to calculate both SDE and ebitda to get an accurate hvac business valuation. SDE is especially useful for owner-operated businesses. It starts with your net earnings, then adds back interest, taxes, depreciation, amortization, and your own compensation. You also add back any personal or discretionary expenses that a new owner might not need.

Here’s a quick table to help you see the difference:

| Metric | Calculation Steps | Common Adjustments |

|---|---|---|

| SDE | Start with net earnings, add back interest, taxes, depreciation, and amortization. | Add back market salary for GM, remove personal expenses, and extraordinary expenses. |

| EBITDA | Focus on operational profitability, typically used for larger evaluations. | Less emphasis on personal expenses, more on operational costs. |

SDE gives you a clear picture of the cash flow you can expect as the owner. It includes things like your salary and any personal expenses you run through the business. This makes it easier for a buyer to see what they could earn if they take over your hvac business.

Ebitda, on the other hand, strips out most personal expenses and focuses on the core profitability of your business. Investors and larger companies prefer ebitda because it shows how well your business performs without the influence of financing or tax decisions.

If you look at Linkwell as an example, you’ll see how a focus on industrial HVAC solutions, like electrical enclosure ventilation, can boost both SDE and ebitda. High-quality products, strong customer relationships, and recurring service contracts all help increase your business’s value.

Using Industry Multiples

Once you have your SDE and ebitda numbers, you need to apply industry multiples to estimate your hvac business’s value. Multiples vary based on your business size, specialization, and market trends. Industrial HVAC businesses, like those selling cabinet air conditioners, often command higher multiples due to their technical expertise and long-term contracts.

Let’s look at some typical multiples for 2025:

| Revenue Range | MVIC-to-SDE Multiple |

|---|---|

| Less than $1M | 2.5 – 3.5 |

| $1M to $5M | 3.25 – 4 |

| Greater than $5M | Greater than 4 |

You can see that industrial hvac businesses, especially those focused on heating or cooling, often achieve ebitda multiples between 5.4x and 6.1x. SDE multiples for industrial companies usually range from 5.4x to 5.5x. If your business is similar to Linkwell, with a strong reputation and advanced products, you may reach the higher end of these ranges.

Note: Residential hvac businesses usually have slightly different multiples, but the process for valuation remains the same. Industrial businesses, like those specializing in cabinet air conditioners, often see higher values due to technical complexity and recurring revenue.

If you want to maximize your hvac business valuation, focus on building recurring revenue, maintaining high product quality, and keeping your financial records clean. These steps will help you achieve the best possible value when you decide to sell or grow your business.

Factors That Impact Value

Recurring Revenue and Service Contracts

You want your hvac business to stand out in the industrial sector. Recurring revenue streams, like annual maintenance contracts, make your business more attractive to buyers. These contracts guarantee predictable cash flow and boost your valuation. When you offer service agreements, you create stability in your financials. Buyers love knowing they can count on steady income. Maintenance memberships often let you command higher multiples—sometimes 1 to 2 turns above businesses without them. If you’re building your business financials, focus on growing these contracts. They can push your value higher and make your hvac business a safer investment.

Tip: Service contracts should clearly list covered equipment, inspection schedules, included parts, and payment options. This transparency increases trust and helps your valuation.

Customer Base and Market Position

A loyal customer base gives your hvac business real strength. If you have long-term clients and solid service agreements, your financials look better. Buyers want to see a diverse customer list and strong market position. When your brand is recognized, you can ask for higher valuation multiples. Take a look at this table to see what matters most:

| Factor | Description |

|---|---|

| Customer Base and Service Agreements | Loyal clients and long-term contracts create predictable revenue and increase value. |

| Market Position and Competition | Strong brand and market dominance attract higher valuation multiples. |

Team and Owner Dependence

Your team plays a huge role in your hvac business’s value. If your business depends on you alone, buyers may hesitate. A fully staffed team with documented processes makes your business easier to transfer and scale. Businesses with strong management get higher valuation multiples. Here’s a quick comparison:

| Business Structure | Valuation Multiple |

|---|---|

| Owner-Dependent | 2x to 3x SDE |

| Well-Structured | 4x to 6x SDE |

If you want to boost your financials, invest in training and reduce owner dependence. This move increases your business’s value and makes your hvac operation more appealing.

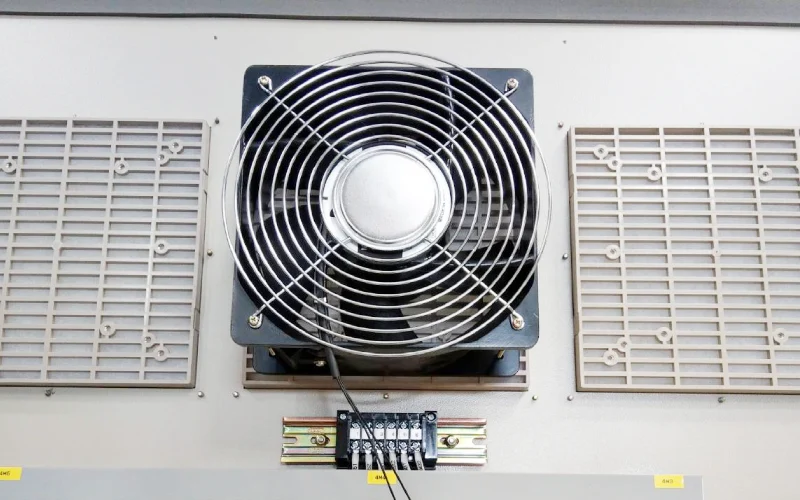

Equipment and Technology (Linkwell Cabinet Air Conditioner)

Advanced equipment sets your hvac business apart. Linkwell cabinet air conditioners deliver reliable cooling for harsh industrial environments. These systems help maintain optimal temperatures, protect sensitive electronics, and lower operational costs. Energy-efficient features and smart controls add even more value. Buyers look for businesses with modern technology and proven products. When you use Linkwell’s solutions, you show commitment to quality and innovation.

- High product quality leads to customer loyalty and repeat business.

- Industry certifications, like UL and CE, prove your expertise and boost your valuation.

- A strong brand reputation builds trust and helps you stand out in the market.

Your financials benefit from these advantages, and your business financials reflect a higher value. If you want to maximize your hvac business’s valuation, focus on equipment, technology, and reputation.

Maximizing Your HVAC Business Value

Strengthen Recurring Revenue

If you want to boost the value of your hvac business, focus on building strong recurring revenue streams. Maintenance contracts and service agreements create predictable cash flow. Buyers love businesses with steady income, especially in the industrial sector. When you offer regular service plans for cabinet air conditioners or electrical enclosure ventilation, you show stability. Investors prefer companies with low customer churn and reliable earnings. This approach not only increases your valuation but also makes selling your hvac business much easier.

- Businesses with more recurring maintenance revenue often get higher valuation multiples.

- Maintenance contracts help you weather slow seasons and keep your cash flow steady.

Improve Operations and Documentation

You can maximize value by improving your operations and keeping clear documentation. Buyers want to see that your hvac business runs smoothly without you. Standard Operating Procedures (SOPs) and organized records make your business more attractive. If you reduce owner dependency, you can command higher valuation multiples. Take time to clean up your financials and prepare financial documents for sale. This step will help you during the hvac business sale process and make due diligence easier.

| Business Condition | Typical Valuation Impact |

|---|---|

| High owner dependency, no SOPs | Lower valuation multiples |

| Low dependency, comprehensive SOPs | Higher valuation multiples |

Highlight Linkwell Product Advantages

When preparing your heating and air conditioning business for sale, highlight the advantages of Linkwell products. Linkwell’s cabinet air conditioners and ventilation systems support both single-phase and three-phase applications. These products deliver reliable performance and efficiency in tough environments. Custom screw terminals ensure secure connections, reducing downtime. Buyers see value in proven, high-quality equipment. Showcasing these strengths can help you stand out and increase your valuation.

Prepare for Sale

To optimize your hvac business for sale, start early. Organize your finances for the past three years and reduce outstanding debts. Streamline daily operations and make sure your team knows their roles. Develop a clear exit strategy and growth plan. Work with an hvac business broker to guide you through how to sell your hvac business and finding the right buyer. Stay focused on business performance during the sale. When you negotiate and close the deal, accurate records and a strong team will help you get the best value.

Tip: Proper preparation before selling your hvac business can make a big difference in maximizing value and attracting qualified buyers.

If you want to get the most out of accurately valuing your hvac business, focus on these essentials:

| Key Considerations | Description |

|---|---|

| System Performance | Maximize ROI with proper sizing and control strategies. |

| Compliance | Meet OSHA and environmental standards for safety. |

| Customization | Tailor solutions for air quality and energy efficiency. |

| Operational Efficiency | Keep up with regular maintenance and organized management. |

Strong products, recurring revenue, and operational excellence help you stand out. You should prepare your records, highlight your strengths, and reach out to valuation experts for the best results.

FAQ

How do you calculate the value of an industrial HVAC business?

You start by figuring out your SDE or EBITDA. Then, you apply the right industry multiple. Strong recurring revenue, quality products, and a loyal customer base can push your value higher.

What makes Linkwell cabinet air conditioners valuable for my business?

Linkwell cabinet air conditioners offer reliable cooling, energy efficiency, and easy installation. These features help protect sensitive equipment and reduce downtime. Buyers see these advantages as a sign of a strong, future-ready business.

Can I increase my HVAC business value with service contracts?

Absolutely! Service contracts create steady, predictable income. They show buyers that your business has loyal customers and stable cash flow. This often leads to higher valuation multiples.

What financial records should I prepare before selling my HVAC business?

You should organize your last three years of financial statements, service contract details, and equipment lists. Clean, accurate records make your business more attractive and speed up the sale process.